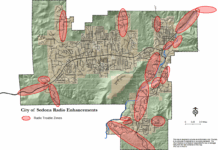

The city of Sedona is moving forward with a plan to extend a temporary half-cent sales tax indefinitely to help cover the costs of transit within the Sedona area.

The Sedona City Council unanimously approved staff moving forward with a plan during its meeting Tuesday, May 11. Staff will now prepare a notice of intent to permanently extend the traffic-related project sales tax increase, which was adopted in early 2018, by way of a new ordinance to fund the transit system.

The city will also comply with the public posting requirements for a tax increase and modification and schedule public hearings regarding the proposal for the end of July.

Sedona City Manager Karen Osburn said that over the course of several meetings, discussion centered on seeking a permanent funding source for the transit master plan, which will cost tens of million of dollars to fully implement.

“Most recently, we discussed the issue of the half-cent sales tax and its possible extension during the February [council] retreat,” she said. “At that time we looked at some data about community sentiment around the desire for transit. And not just the desire for transit but the desire to utilize the half-cent sales tax as an ongoing source to support it.”

Osburn said a pair of figures jumped out at staff when considering this tax extension. The most recent National Citizen Survey showed 81% of the community in support of transit. During the Fiscal Year 2021 budget survey, as well as the National Citizen Survey, when asked about using the half-cent tax to fund transit, 61% responded positively in the budget survey and 68% in the national one.

“When you’re asking about a tax increase, or even a tax extension, those are really high numbers,” Osburn said. “Those are numbers we don’t see when asking about an increase to taxes.”

With community support so high on transit and the idea of extending the tax, Osburn said now is a good time to proceed.

“It is important to note that a dedicated local tax would allow for leveraging of significant federal grant funds — up to 90 cents on the dollar for projects like zero-emission bus technology — that would otherwise be unavailable,” a city report states. “There has been a positive trend toward increasing federal support for local transit programs that have a dedicated local revenue stream. Based on Fiscal Year 2022 sales tax revenue projections, the half-cent tax would generate approximately $3.8 million per year.”

In 2018 a Fiscal Sustainability Work Group made up of Ronald Budnick, Kurt Gehlbach, Doris Granatowski, Lou Harper, Charlotte Hosseini, then-Sedona Fire District Chief Kris Kazian, Holli Ploog — now a city councilwoman — and Economic Development Director Molly Spangler, unanimously voted to recommend the following to council:

■ Increase the city sales tax rate by 1 percent to be dedicated to the funding of transportation-related projects and the cost of additional personnel and project management to accelerate the completion of those projects. Council ultimately approved a 0.5-cent increase.

■ Set a sunset on the tax increase of 10 years or less if deemed appropriate.

■ Continue to fund other non-transportation-related projects with the current funding sources. They also recommended council adopt recommended changes to the current fund balance policy and debt policy.

From the January 4, 2018 story:

Sedona City Council to discuss new 0.5-cent sales tax

… For 10 months, a Fiscal Sustainability Work Group had been meeting once or twice a month to discuss just that — fiscal sustainability. The committee, made up of Ronald Bud-nick, Kurt Gehlbach, Doris Granatowski, Lou Harper, Charlotte Hosseini, Sedona Fire District Chief Kris Kazian, Holli Ploog and Economic Development Director Molly Spangler, covered several topics including fund balance, bonds and funding sources. The group unanimously voted to recommend the following to council:

- Increase the city sales tax rate by 1 percent to be dedicated to the funding of transportation-related projects and the cost of additional personnel and project management to accelerate the completion of those projects.

- Set a sunset on the tax increase of 10 years or less if deemed appropriate.

- Continue to fund other non-transportation-related projects with the current funding sources. They also recommended council adopt recommended changes to the current fund balance policy and debt policy.

Clifton presented the council a breakdown of the dozen or so traffic mitigation projects that have been discussed. He listed each, along with what percentage of each that could be undertaken [50 to 100 percent] yet still be effective. In the end, Clifton presented an estimated budget over the next 10 years of nearly $35 million. This cost would be covered by both a tax increase and use of capital reserves. The estimated cost to fully fund all the projects is around $62 million.

“The really big caveat to this is that we understand that this particular arrangement of projects and revenue assumptions is likely to change quite a lot,” Clifton said after that September meeting. “In other words, it’s really not a commitment to complete the projects as they’re outlined on the spreadsheet. Rather, it reflects that there are various scenarios that could play out but that in any event we should be able to complete a lot of great projects with a half-cent sales tax.”