During the Aug. 22 meeting of the Sedona City Council, the council’s members pressed city Finance Director Cherie White to disclose the proportion of lodging taxes paid by short-term rentals, which White refused to do, citing Arizona Department of Revenue confidentiality rules.

“Why does Scottsdale disclose that number?” Councilman Pete Furman asked. “Look at the city of Scottsdale’s very public website and very beautiful charts.”

“I can’t answer for Scottsdale,” White said.

“The city of Scottsdale takes the standard reports that the Arizona Department of Revenue provides to extract the data on short-term rentals,” Scottsdale Assistant City Manager Brent Stockwell explained when asked about their data disclosure. “Through our licensing system we know who the hoteliers are within the city. Any other property reporting transient activity is considered a short-term rental. The data has been analyzed to ensure that it meets the criteria for disclosure and does not violate confidentiality statutes. To the best of my knowledge, we have not been contacted by anyone from the state or otherwise concerned about the disclosure of this information.”

Scottsdale’s data shows that from September 2019 through May 2023, STRs generated $40,649,478 in revenue for the city. The 2020 revenues were $6,086,986, or 28% of short-term stay revenues, rising to $11,160,117 and 30% in 2021 and then to $13,787,296 and 27% in 2022. STR revenues for the first five months of 2023 were $7,321,587, accounting for 23% of lodging revenues. The average amount of taxes paid by each of Scottsdale’s 3,403 STRs in 2022 was $4,052. These figures include both lodging-categorized sales tax and bed tax.

In response to a suggestion by City Manager Karen Osburn, White previously stated at the Aug. 22 meeting that reporting a number for traditional lodging sales or bed taxes and subtracting it from the category total to arrive at a figure for STR tax payments would also violate ADOR’s confidentiality rules.

White and City Attorney Kurt Christianson further stated that “if 10 or fewer [taxpayers] make up the majority of what’s happening in that category,” the city could not release the data due to ADOR confidentiality rules.

ADOR’s Rule

However, when reaching out to ADOR for clarification, spokeswoman Rebecca Wilder stated, “In order to maintain taxpayer confidentiality, the following standard for disclosing aggregated data is followed.

“All data points in the data set must contain at least 10 taxpayers, and if one of the taxpayers in the data set represents 90% or more of the data point, then that data point must not be disclosed, regardless of the number of businesses. As long as the proportional data that is being shared still meets the criteria listed above, that would be allowable.”

The Sedona Chamber of Commerce estimates that approximately 65 hotels, bed-and-breakfasts, timeshares and other traditional lodging facilities are currently operating in Sedona. These facilities pay taxes in the same category as the 1,100 STRs and at least 33 online lodging marketplaces listing properties in Sedona as of Nov. 6.

A 2021 report by travel research firm Phocuswright found that only 46% of STR users booked through a third-party platform, with approximately 55% of those using AirBNB, 15% using Booking.com and 10% using VRBO.

In response to a Sedona Red Rock News inquiry, White declined to disclose the number of taxpayers in the lodging sales and bed tax categories in Sedona, or whether a single one of those taxpayers accounted for 90% or more of payments in that category, instead providing a copy of a letter from ADOR related to the council’s Aug. 22 discussion.

ADOR’s letter stated that because STRs do not have a different business code than hotels, ADOR is not able to report separate data for STRs and hotels, and that “because of the small number of [online lodging marketplace] taxpayers operating in the city and, indeed, throughout the state, confidentiality rules would prevent us from reporting on these amounts, even in the aggregate, to persons other than city or town tax officials.”

However, the letter added, “certain municipalities may have their own in-house methods for data refinement.”

Elsewhere in Arizona, Paradise Valley Councilwoman Julie Pace stated on July 8, 2022, that Paradise Valley received approximately $3.3 million in resort taxes and $778,000 in STR taxes during FY21, putting their STR share at 19% of the total.

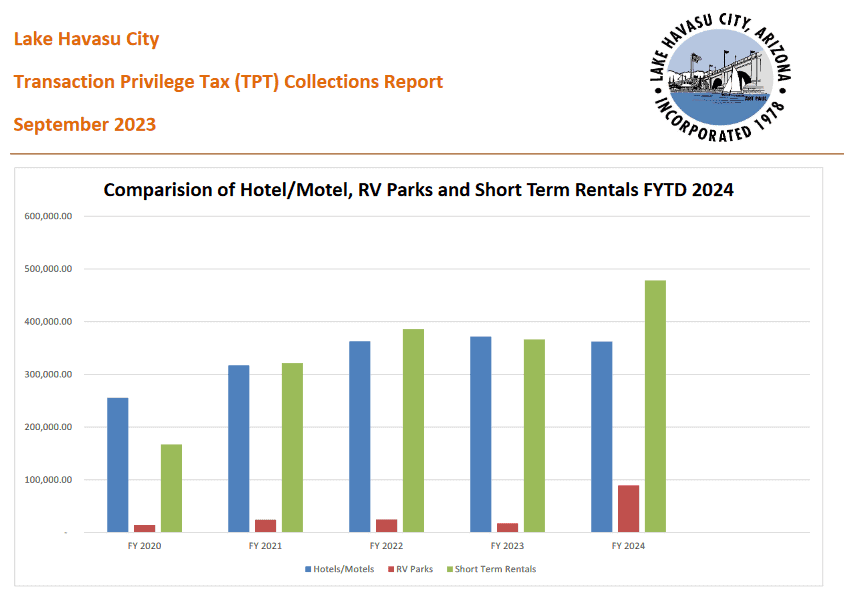

Lake Havasu City began releasing a breakdown of its lodging sales taxes this August; for the first three months of FY24, STRs accounted for slightly more than 50% of lodging tax revenue.

Bisbee finance director Keri Bagley estimated the town’s STR share of lodging revenues at 20% overall, ranging from 10% in August to 27% in March and 28% in January.

Drilling Down

Although White did not disclose the proportion of Sedona’s hotel sales taxes paid by STRs, rough estimates can be made using alternative methods based on existing data:

- City staff estimate that there are approximately 1,100 STRs in Sedona. According to AirDNA, the average daily rate for an STR in Sedona is $301, which is slightly below the average daily rate for traditional lodging in fiscal year 2023, and the occupancy rate for Sedona’s STRs is 70%, which is slightly higher than the FY23 rate of 65% occupancy for traditional lodging. On this basis, Sedona’s STRs would generate annual revenues of $84.6 million, of which the city’s share would be $5.92 million total, and $2.96 million each in hotel-categorized sales taxes and bed taxes. This would account for 33.6% of FY23 lodging sales taxes and 34.4% of FY23 bed taxes.

- Scottsdale’s average annual tax revenue from one STR in 2022 was $4,052. If Sedona is receiving a comparable amount from each of its 1,100 STRs, its total sales and bed tax revenues from STRs would be $4.46 million, or 25.6% of its $17.4 million FY23 hotel sales and bed tax collections. Alternatively, since STRs were the source of 27% of Scottsdale’s short-stay revenues in 2022, if 27% of Sedona’s short-term tax collections also came from STRs, they would have paid a total of $4.7 million in hotel sales and bed taxes during FY23.

- If there are approximately 1,100 STRs and 2,800 hotel rooms in Sedona, both of which rent for similar rates and thus pay similar amounts of taxes, the STRs would represent 28.2% of total tax receipts.

- A 2022 report by Rounds Consulting Group found that local governments in Arizona received $263 million in tax revenue from STRs during 2021. Coconino County received $5.24 million in STR-related direct sales and bed tax revenue against sales tax revenues of $18.63 million, making STRs 28% of the total. Yavapai County received $2.68 million in STR-related direct sales and bed tax revenue against sales tax revenues of $22.92 million, making STRs 12% of the total.

The midpoint of the range of 25.6% to 34.4% is 30%, suggesting that Sedona’s STRs are paying roughly 30% of the city’s lodging taxes.